About Me

About Me

Who is Sir Jo?

Who is Sir Jo?

Hi! I’m Jonathan Ventula Mendoza, a licensed Financial Wealth Planner based in Metro Manila with FWD Life Philippines.

Before ko pasukin ang insurance industry in 2025, I spent 9 years as a software engineer. Fun fact: I already owned 8 insurance policies from different companies bago ako nag-decide na sumali sa industriya mismo.

From Tech to Insurance: My Journey

From Tech to Insurance: My Journey

Noong 2021, 25 years old pa lang ako, I bought my first personal insurance plan — PRULink Elite 7 from Pru Life UK. Monthly premium: ₱12,500.

Two months later, kumuha ulit ako ng policy para sa nanay ko (44 years old at that time): PRULink Elite 15, ₱6,500/month for 15 years. Secret ko itong ginawa kasi hindi supportive ang family ko sa insurance — may trauma sila sa CAP (College Assurance Plan).

Gusto ko rin sanang i-insure si Papa, pero at 52 years old, kailangan na ng medical exam, so hindi na natuloy.

Sa puntong ‘yon, I was already paying ₱19,000/month in premiums kahit ₱42,000 lang ang sweldo ko (45.2% ng income!). Buti na lang I was working from home at nakatira pa sa parents kaya kinaya.

Pero ngayon, as a financial planner, I don’t recommend lumagpas sa 20% ng income for insurance. The best plan is always the one you can afford. Kaya lagi kong tinatanong ang monthly income ng mga clients before making proposals.

Family Struggles: Why This Matters to Me

Family Struggles: Why This Matters to Me

Fast forward to September 2023 — my sister (22 at that time) was diagnosed with early-stage thyroid cancer. Buti na lang may doctor na tumulong sa kanya with free VIP room and discounts sa surgery. Pero para sa ibang gastos, we still had to raise funds from government officials.

Then on April 21, 2024, na-ambulance si Papa to Chinese General Hospital. Diagnosis: multiple complications from untreated pneumonia. Sadly, he passed away on April 24, 2024, three days before my birthday.

His company’s Group Life Insurance (Manulife) gave us ₱162,000, enough para matuloy pag-aaral ng kapatid ko. Buti may Maxicare HMO din siya; PhilHealth didn’t cover anything because of their 96-hour rule sa sepsis.

Sa funeral, ginamit ni Mama yung sarili niyang St. Peter Life Plan para kay Papa. Hindi siya nakabili ng life insurance for herself, pero at least may plan siya para hindi kami mahirapan sa libing niya later on.

A Wake-Up Call

A Wake-Up Call

During Papa’s wake, very few people came. Yung mga dating kasama niya sa trabaho, dumaan lang saglit — tapos nakita pa ng kapatid ko na after lumabas, nag-party pa sila sa bar.

Doon ko naisip: “Ganyan din kaya mangyayari sa’kin pag ako naman?”

And then, habang nagluluksa pa kami, my uncle (mother’s side) suddenly passed away from heat stroke. My mom had to fly immediately to attend another funeral.

That week showed me just how harsh life can be. Kapag walang insurance, families are left not only with grief but also financial burdens.

My Mission Now

My Mission Now

Dahil sa mga nangyari, I became a strong believer in insurance. Kaya ako sumali sa industry — para matulungan ang mga pamilya maghanda sa uncertainties ng buhay.

Ang hope ko: by the time I leave this world, I’ve contributed positively to my community — and that I won’t be alone at my own funeral.

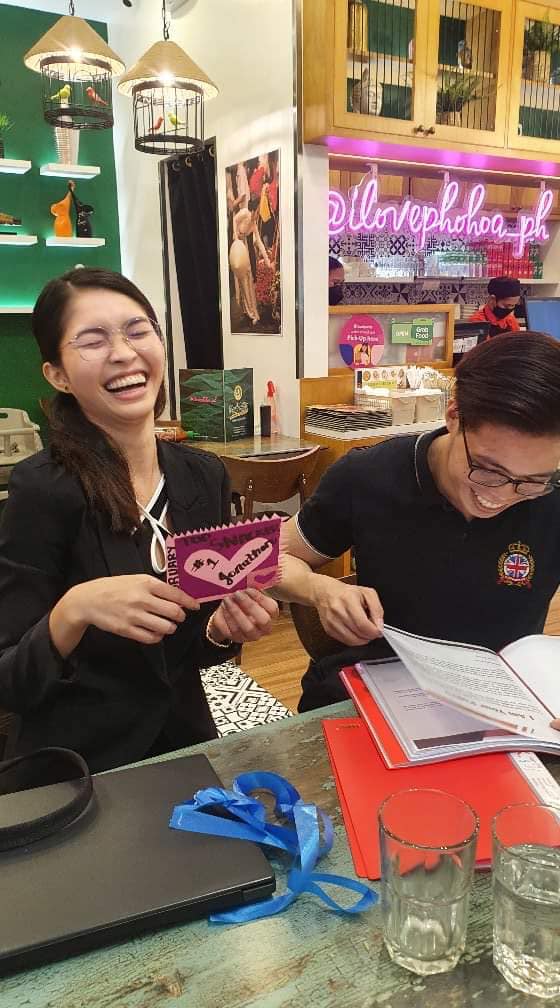

About the Author

About the Author

Jonathan Ventula Mendoza

💼 Licensed FWD Financial Wealth Planner

Helping Filipinos build a secure and confident financial future — one plan at a time.