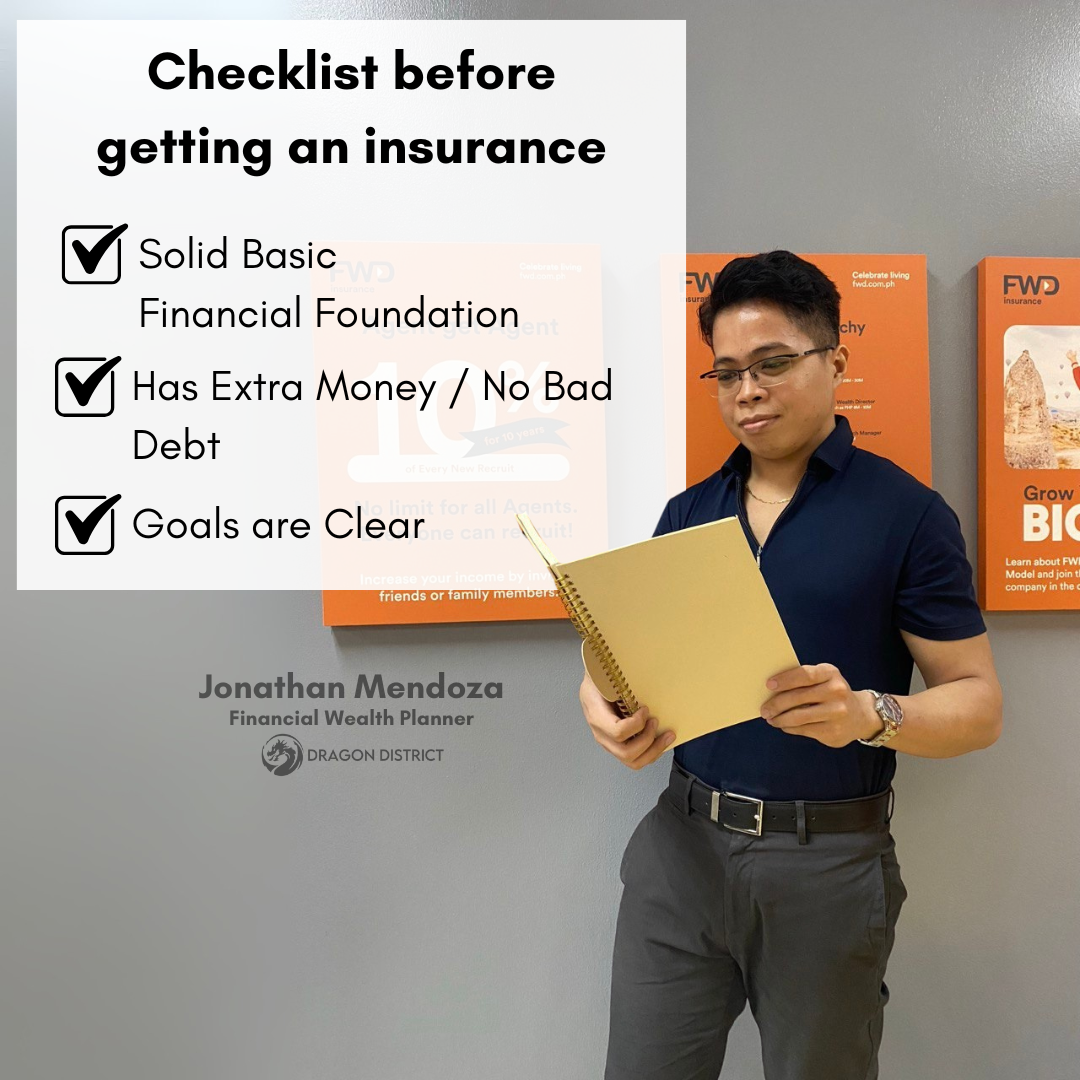

Checklist Before Getting an Insurance

Checklist Before Getting an Insurance

Insurance is one of the most important financial tools you can have — but before you get one, it’s crucial to prepare yourself. Think of it as building a strong foundation before putting up the walls of your house. Here’s a simple checklist to guide you before getting insurance:

1. Solid Basic Financial Foundation

1. Solid Basic Financial Foundation

Bago kumuha ng insurance, siguraduhin muna na kaya mong tustusan ang iyong basic needs:

- Food

- Shelter

- Utilities

- Transportation

Kapag stable na ang iyong cash flow at hindi ka nahihirapan sa araw-araw, mas madali mong mababayaran ang iyong insurance premiums nang tuloy-tuloy.

2. Has Extra Money / No Bad Debt

2. Has Extra Money / No Bad Debt

Insurance is not an expense, but a long-term protection and investment.

Pero kung baon ka sa bad debt (credit card bills, high-interest loans), mahihirapan ka lang mag-commit.

Make sure may extra cash ka buwan-buwan para hindi ka maipit kapag may kailangan kang bayaran.

3. Goals are Clear

3. Goals are Clear

Bawat insurance policy ay dapat naka-align sa iyong personal financial goals. Tanungin ang sarili:

- Gusto ko bang may Income Protection para sa pamilya ko kung may mangyari sa akin?

- Kailangan ko ba ng Critical Illness Benefit para protektado laban sa malalaking gastusin?

- Paano kung mawalan ako ng kakayahang magtrabaho — kailangan ko ba ng Disability Income Protection?

- Gusto ko bang mag-ipon para sa mga Dream Builders (bahay, negosyo, investments)?

- May plano ba akong maghanda ng Education Fund para sa anak ko?

- Naghahanda ba ako para sa Retirement?

- O iniisip ko na rin ang Estate Planning para sa generational wealth transfer?

Kapag malinaw ang goals, mas madali kang makakapili ng tamang insurance plan na babagay sa iyong sitwasyon.

Final Thoughts

Final Thoughts

Insurance is not just about paying premiums — it’s about protecting your future, your family, and your dreams. Pero bago ka pumasok, siguraduhin na handa ka sa tatlong bagay na ito: financial foundation, extra cash flow, at malinaw na goals.

Take the Next Step

Take the Next Step

📝 Kung gusto mong malaman kung alin sa mga insurance solutions ang bagay sa iyo, let’s talk. Together, we can design a plan that fits your needs today and prepares you for tomorrow.

About the Author

About the Author

Jonathan Ventula Mendoza

💼 Licensed FWD Financial Wealth Planner

Helping Filipinos build a secure and confident financial future — one plan at a time.