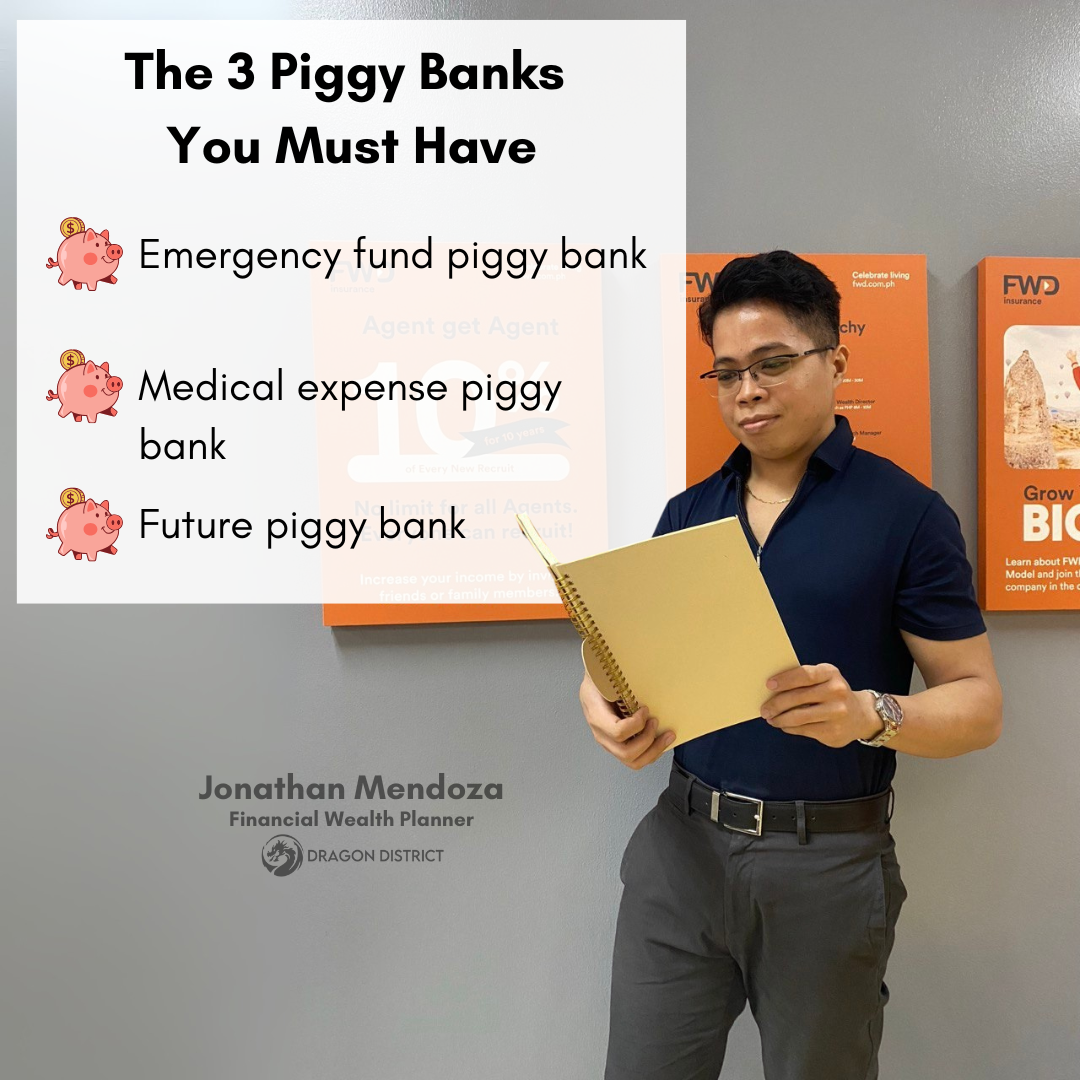

The 3 Piggy Banks You Must Have

The 3 Piggy Banks You Must Have

Pagdating sa financial planning, hindi sapat na may isa ka lang ipon account. Para siguradong ready ka sa kahit anong sitwasyon, kailangan mong hatiin ang pera mo sa tatlong piggy banks — bawat isa may specific purpose para sa financial security mo.

Emergency Fund Piggy Bank

Emergency Fund Piggy Bank

Ito ang safety net mo para sa mga short-term emergencies tulad ng:

- Biglang mawalan ng trabaho

- Pagkumpuni ng sasakyan o bahay

- Unexpected bills

📌 Rule of Thumb: Mag-ipon ng 6–9 months’ worth ng monthly expenses mo. Para kahit may mangyari, may cash ka agad na mahuhugot.

Medical Expense Piggy Bank

Medical Expense Piggy Bank

Ayaw man natin, pero totoo — kapag nagkasakit, mabilis maubos ang pera. Kaya kailangan ng Medical Piggy Bank para may pangtustos kapag may health issues at hindi ka makapagtrabaho.

📌 Rule of Thumb: Maghanda ng at least 5x ng annual income mo for critical illness protection.

Future Piggy Bank

Future Piggy Bank

Ito naman ang para sa mga long-term goals mo tulad ng:

- Retirement

- Education fund ng mga anak

- Estate planning at legacy building

📌 Rule of Thumb:

- 20% ng income para sa retirement

- 5% para sa education (kung may anak)

- Life insurance worth 10x ng annual income mo para secure ang pamilya kung may unexpected na mangyari

Final Thoughts

Final Thoughts

Ang tanong… meron ka na ba ng lahat ng 3 Piggy Banks na ‘to?

Kung wala pa, don’t worry. Hindi kailangan sabay-sabay mong buuin. Pwede kang magsimula sa Emergency Fund, habang tutulungan kita i-maximize ang Medical Fund at Future Fund gamit ang tamang insurance at financial strategies.

Take the Next Step

Take the Next Step

🔸 Let’s start building your 3 Piggy Banks today. Para ikaw at pamilya mo, fully protected sa ngayon at sa future.

About the Author

About the Author

Jonathan Ventula Mendoza

💼 Licensed FWD Financial Wealth Planner

Helping Filipinos build a secure and confident financial future — one plan at a time.