About the Author

About the Author

Jonathan Ventula Mendoza

💼 Licensed FWD Financial Wealth Planner

Helping Filipinos build a secure and confident financial future — one plan at a time.

About the Author

About the AuthorJonathan Ventula Mendoza

💼 Licensed FWD Financial Wealth Planner

Helping Filipinos build a secure and confident financial future — one plan at a time.

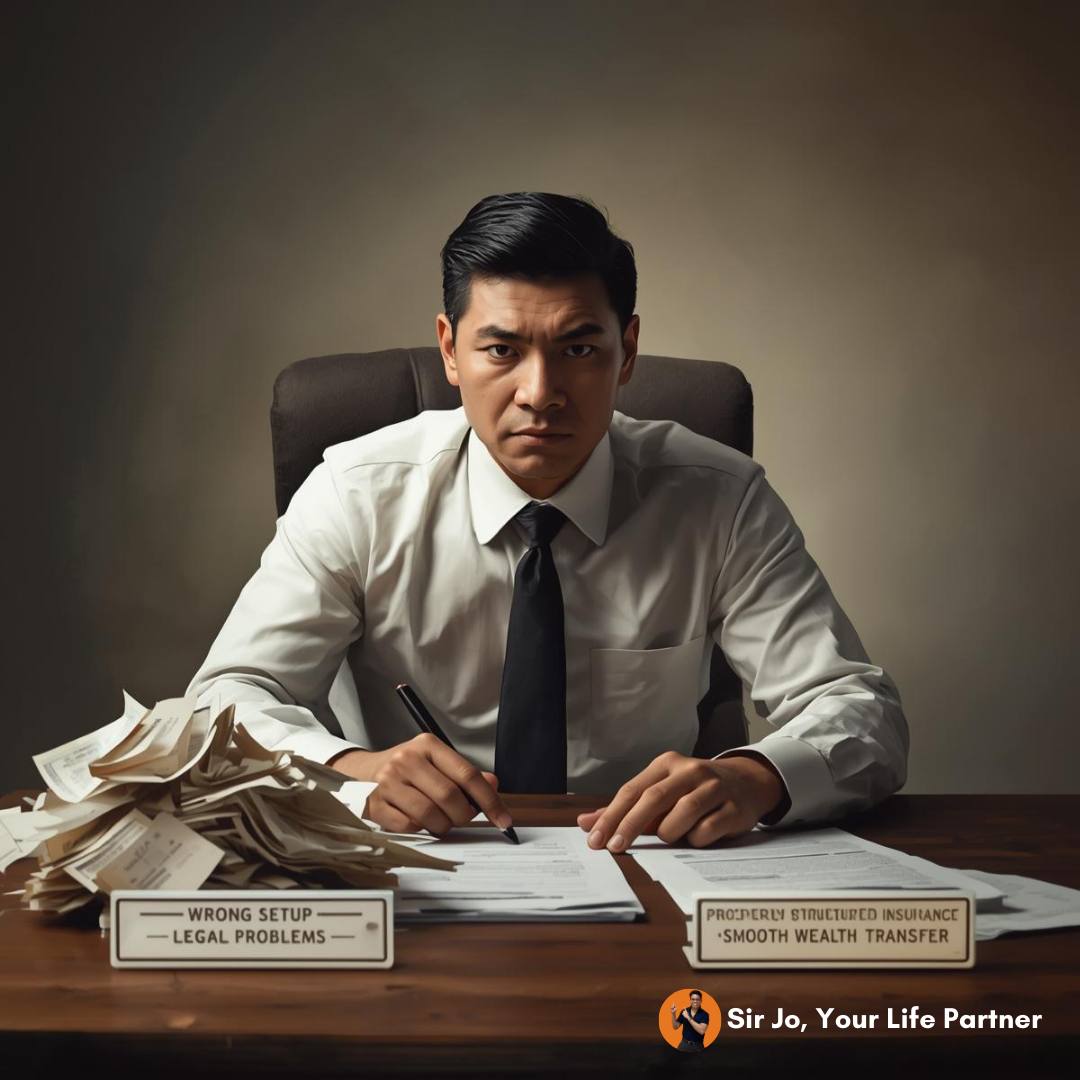

A Story About Why Getting the Right Insurance Matters Just as Much as Getting One at All

A Hardworking Father With Big Dreams

A Hardworking Father With Big DreamsSi Marco, 42 yrs old, isang negosyanteng masipag at dedicated father to two young kids. Stable ang negosyo niya. Maganda ang kita.

Pero dahil sa dami ng responsibilities, lagi niyang iniisip:

“Sapat ba ‘yung paghahanda ko para sa pamilya ko… kung bigla akong mawala?”

Like most business owners, he wanted his wife (not legally married) and children to be financially secure no matter what happens.

His Friend’s ‘32 Insurance Policies’ Story — And the Hidden Problem

His Friend’s ‘32 Insurance Policies’ Story — And the Hidden ProblemOne day, Marco met up with his long-time business friend, si Adrian.

Adrian was known for being close to his bank — lagi siyang inaalok ng loans, VIP treatment, at exclusive business perks.

At dahil gusto niyang ma-maintain ang “good relationship” with the bank, he said yes to every insurance policy they offered.

He ended up buying 32 insurance policies.

But here’s the twist:

Adrian assumed:

“Basta marami akong policies, safe na pamilya ko.”

Pero hindi iyon ang nangyari.

The Unexpected Happened

The Unexpected HappenedThree years later, Adrian suddenly passed away.

His grieving wife immediately went to the bank to file for claims.

And that’s where the nightmare began.

The Painful Truth She Discovered

The Painful Truth She DiscoveredBut here’s the problem:

Even though the policies were beyond the contestability period, she couldn't access her own family's money.

To claim the ₱16M, she had to:

What should have been an instant pamana became:

All because:

“Hindi properly naka-structure ang insurance.”

The Only Good News

The Only Good NewsThe 28 policies under the kids?

But this didn’t erase the unnecessary suffering of the wife.

It was a disaster that could have been avoided

— if only someone guided him properly.

Marco Realized Something Important

Marco Realized Something ImportantListening to the story, Marco felt a chill.

But because Adrian’s wife suffered at the most vulnerable moment of her life — when she should have been receiving support, not bills.

Marco thought to himself:

“Ayokong maranasan ‘yan ng pamilya ko.”

Why He Chose to Ask for Financial Guidance First

Why He Chose to Ask for Financial Guidance FirstBefore buying anything, Marco finally decided:

He booked a free consultation — not to buy immediately, but to be informed.

And for the first time, someone explained to him:

Marco walked away with clarity — and peace.

Because this time, he was making decisions with proper guidance, not guesswork.

The Moral of the Story

The Moral of the StoryInsurance is not just about buying a plan.

It’s about designing your family's safety net properly.

The wrong setup can:

A well-structured plan can:

Your insurance should be a blessing — never a burden.

If You’re a Parent, Business Owner, or Breadwinner…

If You’re a Parent, Business Owner, or Breadwinner…Don’t wait for mistakes to teach you the lesson.

Let’s build a solid, properly structured insurance plan for your family — one that truly works the way you intend it to.

📝 Sign-up for a Free Consultation

Let’s make sure your legacy is protected, clearly assigned, and stress-free for your family.

💬 Just answer a few questions — it only takes 2 minutes!

Step 1: Personal Info

🚻 Gender:

💍 Civil Status:

❤️ Do you have any pre-existing medical condition?

🛡️ Do you already have an existing insurance policy?

🧠 We’ll calculate your estimated coverage amount and show how much protection you’ll need for your top priorities. The recommended coverage benefits will be sent to your email address.